Federal Lending Institution: Your Portal to Financial Success

By providing customized academic sources and economic remedies, Federal Credit report Unions lead the way for their participants to reach their monetary objectives. Sign up with the conversation to uncover the crucial benefits that make Federal Debt Unions the entrance to monetary success.

Benefits of Joining a Federal Cooperative Credit Union

Signing Up With a Federal Credit score Union uses many benefits that can substantially boost your financial health. Federal Debt Unions are not-for-profit companies, so they usually have lower overhead expenses, permitting them to pass on these cost savings to their participants in the form of decreased charges for solutions such as examining accounts, fundings, and debt cards.

One more advantage of signing up with a Federal Debt Union is the individualized service that members obtain - Credit Unions Cheyenne WY. Unlike big financial institutions, Federal Credit scores Unions are known for their community-oriented technique, where members are treated as valued individuals instead of simply an account number. This customized solution usually converts right into even more customized economic services and a better general financial experience for participants

Range of Financial Providers Provided

Federal Credit report Unions use a detailed variety of monetary services created to cater to the varied demands of their members. These organizations prioritize economic education by supplying workshops, workshops, and on the internet resources to equip participants with the understanding required to make informed monetary choices. By offering this wide range of services, Federal Credit report Unions play an important function in supporting their participants' financial health.

Affordable Rates and Personalized Service

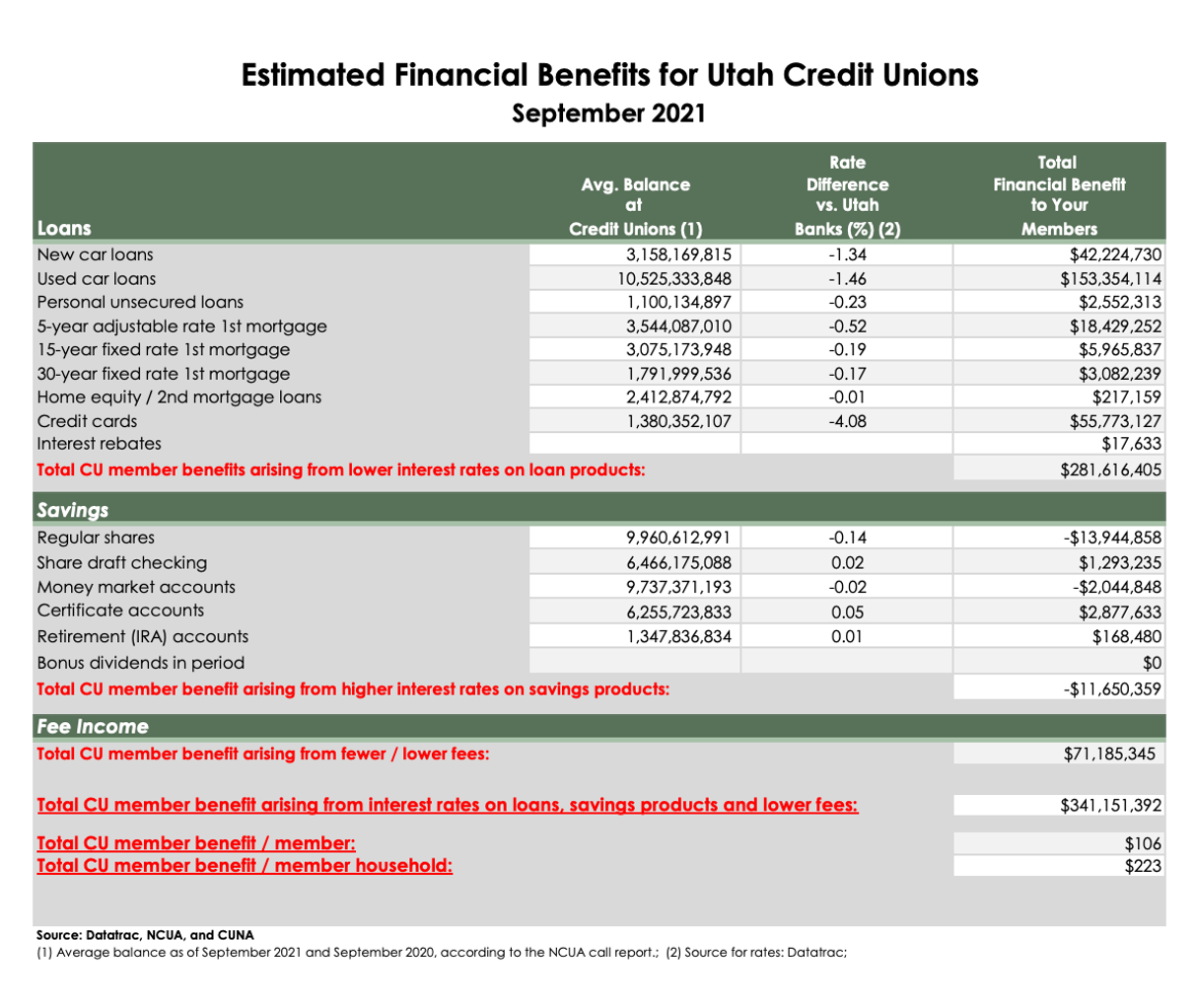

In the realm of monetary services provided by Federal Cooperative credit union, one standout element is their dedication to supplying competitive rates and personalized service to guarantee members' fulfillment. Federal Cooperative credit union aim to offer their participants with prices that are typically more beneficial than those provided by traditional financial institutions. These competitive prices reach various financial items, consisting of interest-bearing accounts, loans, and charge card. By using affordable prices, Federal Cooperative credit union help their participants save cash on interest settlements and gain more on their down payments.

Exclusive Perks for Participants

Members of Federal Credit scores Unions get accessibility to a range of unique benefits developed to improve their economic wellness and total financial experience. Federal Credit report Union members likewise have actually access to individualized financial suggestions and support in producing spending plans or managing financial debt.

On top of that, Federal Lending institution usually provide advantages such as reduced prices on insurance coverage products, credit monitoring services, and identification theft defense. Some credit scores unions even provide special member price cuts on regional events, destinations, or services. By becoming a participant of a Federal Cooperative credit union, people can take pleasure in these special benefits that are tailored to help them conserve cash, construct riches, and accomplish their economic objectives.

Getting Financial Goals With Federal Lending Institution

Credit unions offer as vital partners in assisting individuals accomplish their economic goals through customized monetary options and customized advice. One key facet of accomplishing financial objectives with federal credit scores unions is the focus on participant education and learning.

In addition, government credit history unions give a vast array of services and products designed to support participants in reaching their monetary milestones. From competitive interest-bearing More Bonuses accounts and low-interest financings to retirement planning and financial investment possibilities, credit scores unions use extensive remedies to address varied economic demands. By leveraging these offerings, members can develop a solid monetary foundation and job towards their lasting goals.

Additionally, federal lending institution often have a community-oriented technique, fostering a sense of belonging and assistance amongst members. This communal element can further motivate people to stay committed to their monetary goals and commemorate their success with like-minded peers. Inevitably, partnering with a federal cooperative credit union can significantly boost an individual's journey in the direction of economic success.

Verdict

To conclude, government lending institution use a variety of monetary services and advantages that can aid individuals additional resources attain their economic goals. With competitive rates, customized service, and special member advantages, these not-for-profit companies offer as an entrance to monetary success. By prioritizing participant education and area participation, federal credit score unions equip people on their trip towards financial security and success.

By supplying tailored economic solutions and academic sources, important link Federal Credit report Unions pave the means for their members to reach their financial objectives. These institutions focus on financial education and learning by offering workshops, seminars, and online resources to encourage participants with the expertise required to make enlightened economic decisions. Whether it's applying for a loan, setting up a savings plan, or looking for financial suggestions, members can anticipate customized service that prioritizes their monetary wellness.